The resource curse and Switzerland

©

[Translate to English:]

©

[Translate to English:]

The main question posed by the resource curse is why countries with mineral and fossil wealth persistently remain extremely impoverished. If resource wealth effectively benefitted the population of the global South, some 540 million people would be able to lift themselves out of poverty by 2030.

Not an inevitable fate

Countries that rely on income from natural resources such as Botswana, Canada, Indonesia, Norway or Oman use their wealth prudently. Moreover, in Africa, resource-rich countries are on average wealthier than those without natural resources. Nevertheless, it is widely felt that resource-rich countries could – and must – experience better growth than they do in practice.

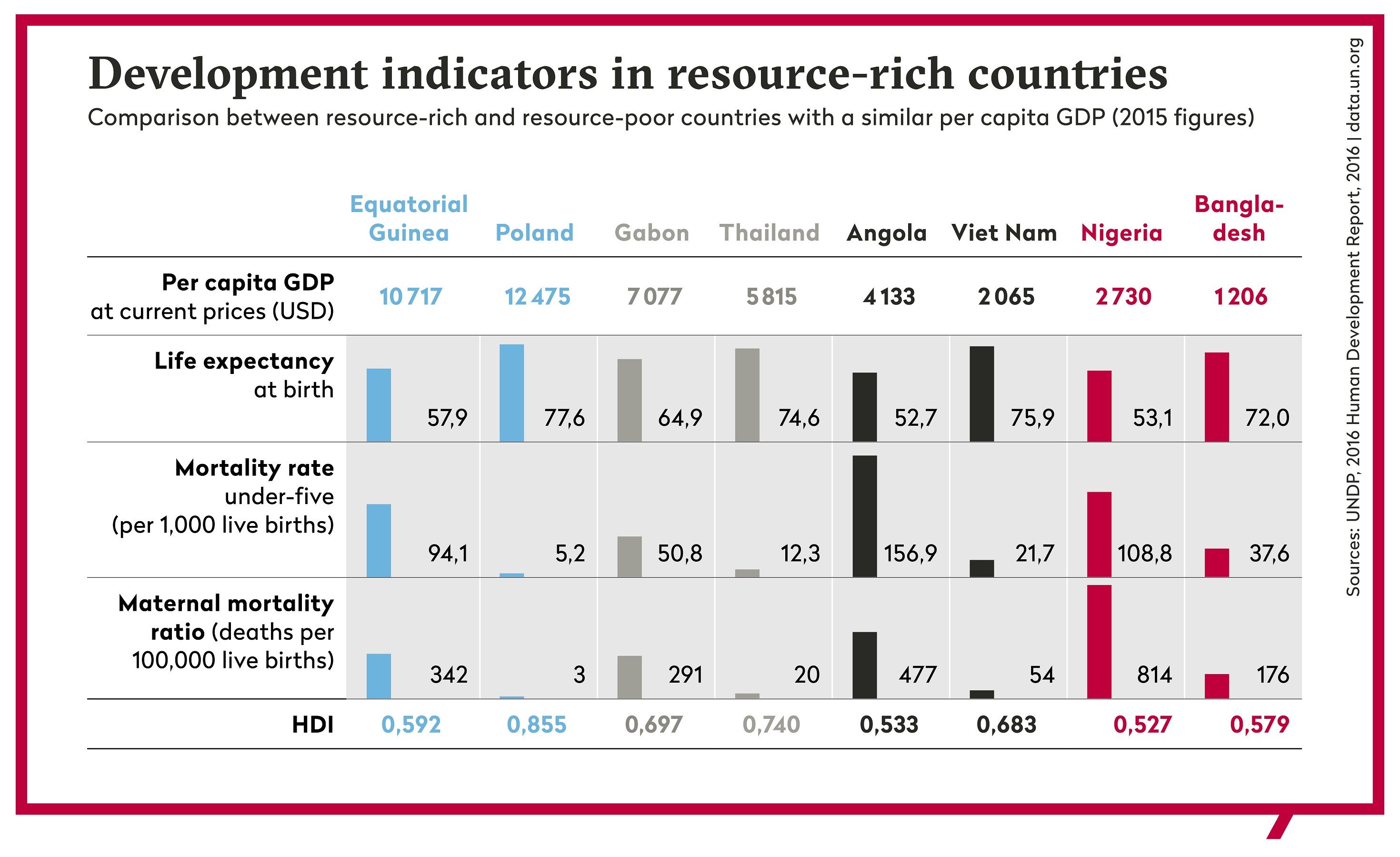

Examining development indicators instead of economic growth figures throws the problem into even sharper relief: most of the countries with the highest child mortality rates in the world are resource-rich African countries. In Nigeria or Angola for instance, poverty rates skyrocketed despite economic growth driven by the oil boom. Equatorial Guinea’s per capita GDP ranks 39th globally yet the country ranks only 135th (out of 188 countries) on the UN’s Human Development Index (2017).

©

Public Eye

©

Public Eye

This divergence between economic growth and human development can be explained by the extremely unequal distribution of incomes. Angola is a textbook example of this: despite the oil boom, over 40% of the population continues to live below the poverty line while in 2013 the president’s daughter, Isabel dos Santos, became the first African woman to come top of The Forbes Billionaires List.

Former UN Secretary-General Kofi Annan’s jointly published Africa Progress Report (2013) outlined the main reason for persistent poverty in resource-rich countries:

“The degree to which governments are able to capture for the public purse a fair share of the export wealth generated by minerals depends on the efficiency of taxation, and on the practices of investors."

"Many countries […] are losing revenues as a result of weak management of concessions, aggressive tax planning, tax evasion and corrupt practices.”

A lack of responsibility among producing and trading companies

According to the Africa Progress Report, producer countries’ failure to absorb natural resources wealth is directly linked to the practices of investors. The resource curse cannot be mitigated unless income from natural resources is distributed more fairly between producer countries and – mostly foreign – companies. Oxford professor and advisor to the UK government Paul Collier also stresses the responsibility incumbent upon companies: “

Unlike purely productive activities, resource extraction generates rents as well as profits, as inherently valuable assets are lifted from the ground… Spectacular “profits” from resource extraction are likely to be rent-seeking: companies acquiring the natural assets of poor people. Such behaviour demonstrates not exceptionally high business talent but exceptionally low corporate ethics”.