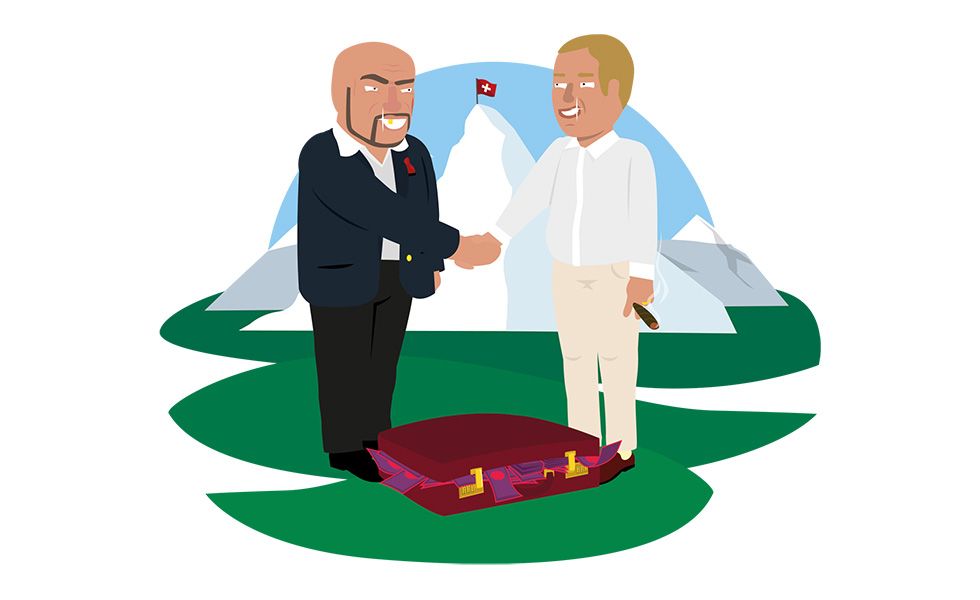

"Corruption for Dummies" - Public Eye offers advice to kleptocrats on how to best use Swiss financial services

Zurich, Lausanne, 14. September 2021

Every year, corruption and money laundering take USD 3,600 billion away from state budgets. Switzerland is in part responsible for this huge racket, whose primary victims are the populations and countries of the Global South. 1MDB, Lava Jato or PDVSA – all the large international corruption scandals "pass" through Switzerland. But the banks that harbour illicit wealth or turn a blind eye to suspicious transactions are not the only ones involved. Swiss lawyers and trustees also play a key role in setting up and administering shell companies that serve to conceal illegitimate or illegal activities, as revealed by the Panama Papers and other data leaks.

With its Swiss handbook for white collar criminals, Public Eye takes a satirical approach to exposing the legislative loopholes and other advantages that our lovely country provides to those interested in corruption and money laundering. We also offer tips on how to best exploit them and introduce the facilitators in Switzerland available to help conceal dubious funds and outrun the judiciary. To show that the integrity of Switzerland’s financial industry – as presented by the Federal Council – is a political illusion, Public Eye has launched an online campaign to officially corrupt Finance Minister Ueli Maurer. In a week, 5.9 million (symbolic) Swiss Francs were collected to encourage him to eventually combat corruption "made in Switzerland." The false notes will be handed over to him once a juicy bribe of CHF 20 million has been collected.

Despite its sardonic tonality, this campaign is based on an in-depth investigation. Public Eye is not the only organisation to deplore the shortcomings of Switzerland’s provisions against corruption and money laundering. International specialists at the Financial Action Task Force (FATF) are also calling on Switzerland to close its legal loopholes. But the Swiss authorities still oppose any regulation. Last spring, the bourgeoise majority in parliament refused to expand the Anti-Money Laundering Act to cover advisory services related to offshore companies, notably services provided by lawyers. This provision was advocated by the FATF and would have made it possible to impose due diligence obligations and to facilitate the judiciary’s work. Switzerland has also refused to set up a public register of beneficial owners of companies, although this is one of the most effective measures in combatting economic crime.

For more information, please contact:

Oliver Classen, Media Director, +41 44 277 79 06, oliver.classen@publiceye.ch

David Mühlemann, Finance and Legal Expert, +41 44 277 79 24, david.muehlemann@publiceye.ch