Fast Fashion Interviews with factory employees refute Shein’s promises to make improvements

by Oliver Classen and David Hachfeld, May 14, 2024

“I work every day from 8 in the morning to 10.30 at night and take one day off each month. I can’t afford any more days off because it costs too much.” This statement was made by a man who has been working at sewing machines for over 20 years and, at the time of the interviews, was making the particularly noticeable turn-up seams for Shein products on a piecework basis. Our investigation partners talked to him and 12 other textile workers working for suppliers to the Chinese fashion group in late summer 2023. The interviews were conducted in production facilities located just west of Nancun Village, but still in the greater Guangzhou area in southern China.

Overview of the follow-up investigation

Survey period: Late summer 2023.

Interviewees: 13 employees (7 women, 6 men) aged between 23 and 60.

Location of six factories: Chen Bian Garment Industrial Park, Yuangang Industrial Park, Li Village, Zhi Village and Tangxi Industrial Park. All of them are located in Guangzhou’s Panyu District in Guangdong Province, China.

Unlike some other fashion companies, Shein does not reveal its suppliers. The production processes for Shein were established based on the interviewees’ responses and the Shein products visible during manufacturing.

In Nancun itself, where Shein’s headquarters are located and the interviews for our report "Toiling away for Shein” took place two years earlier, the atmosphere was too risky to conduct any meaningful follow-up interviews. One reason for this was that many international media outlets had followed up on our investigation and delved further into this matter, which put the dark side of Shein’s glittering digital world in the spotlight worldwide, thereby exerting strong pressure on the rapidly expanding company to justify itself.

©

anonymous

©

anonymous

75-hour week still the norm

The six production sites visited on this occasion again mostly comprised small workshops employing 40 to 80 workers, but also included two larger factories with up to 200 workers. In both cases, interviewees stated that they worked an average 12-hour working day – minus lunch and dinner breaks – at least six, but usually even seven days a week. One company was found to officially close at night – but only at 11 p.m. The horrendous workload mentioned by the worker quoted above seems to continue to be the norm. In other words, the 75-hour weeks that we found out about two years ago still seem to be common at Shein. In its detailed response* to this finding and our questions, the company stated that “long working hours are a well-known, long-term issue.” According to its Code of Conduct for suppliers, they must not work more than 60 hours per week (including overtime). Not to mention that employees ought to have at least one day off per week.

Regarding wages, there were hardly any changes either, according to the interviewees. They gave similar figures for earnings to those in the 2021 report. Depending on the factory, season and level of expertise (and only including excessive overtime hours!) the wages of ordinary workers fluctuate between 6,000 and 10,000 yuan per month (equivalent to CHF 765-1240), although there are strong seasonal fluctuations and the salary still depends on the number of items produced.

Anyone in their late 30s is still considered young for production work at these Shein suppliers. This is because they need to have quite a bit of professional experience to handle the small quantities and constantly changing patterns. That’s why experts like the one mentioned earlier, specializing in cover stitches, sometimes receive more than 10,000 yuan per month. Other needleworkers reported wages between 6,000 and 8,000 yuan, while quality checkers reported around 7,000 yuan.

More infos

-

Putting wages in context

- At first glance, a monthly wage of 6,000 yuan seems like a lot for China’s textile industry. However, if workers have to work 75 hours a week instead of the normal 40 hours, the basic wage, after deducting overtime pay (at 150 percent of the normal wage and 200 percent on days off), comes down to only about 2,400 yuan per month.

- According to calculations performed by the Asia Floor Wage Alliance, a living wage in China, which covers a family’s basic needs, is currently 6,512 yuan (around CHF 830). The statutory minimum wage in Guangzhou is 2,300 yuan, which is only a fraction of this reference value. In other provinces such as Hubei, Hunan, and Jiangxi, where the interviewees said that factories outsource individual production steps, the minimum wage is even lower.

©

panos

©

panos

Obscure audit and blatant “whataboutism”

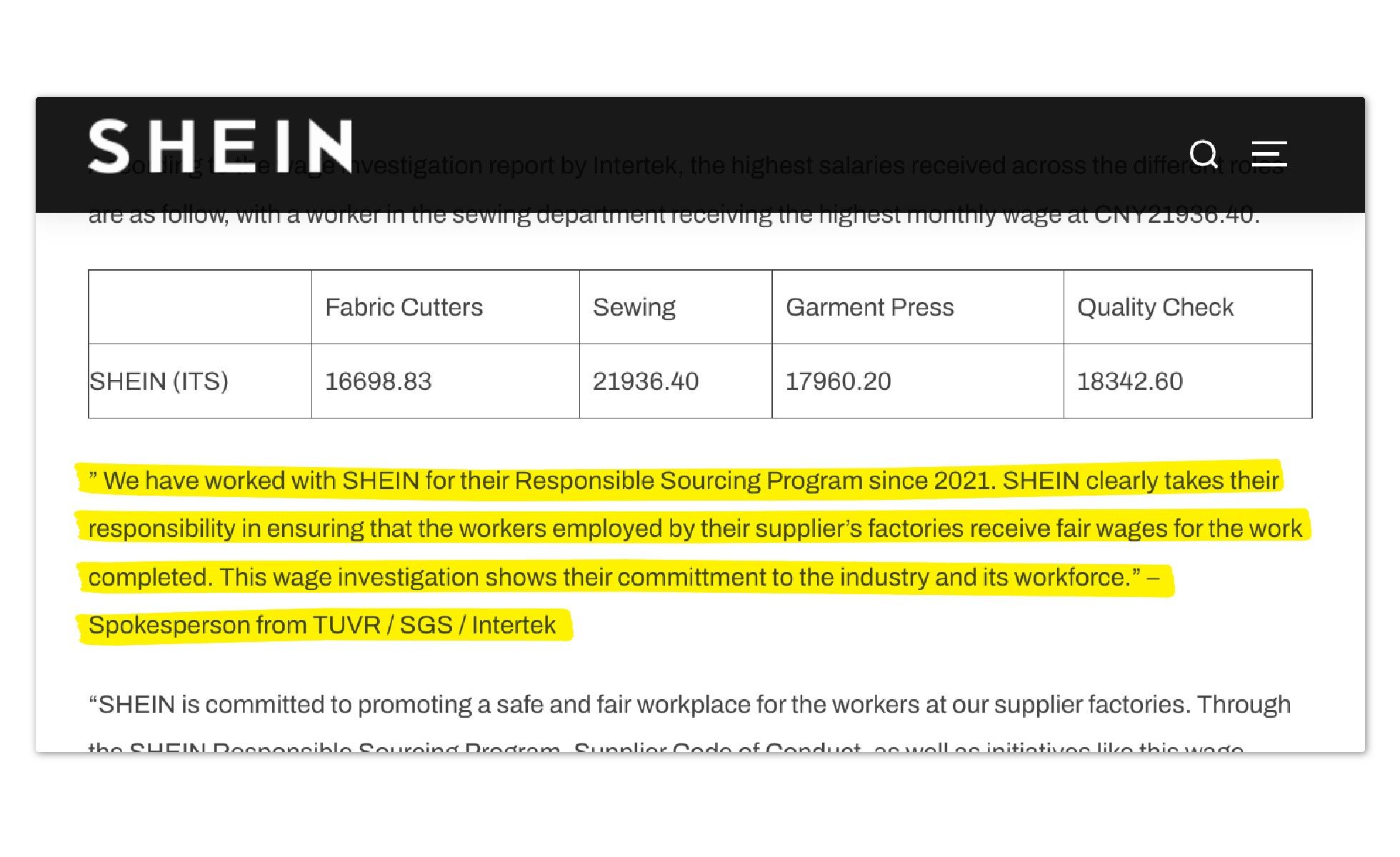

After our pioneering investigation published in mid-November 2021, Shein’s newly hired sustainability manager reassured enquiring media outlets that his company was taking the appalling findings seriously. However, the company explicitly reacted only after “Inside the Shein Machine” was broadcast by Channel 4 a year later. The company’s response to this investigative TV report also mentioned an audit highlighting that everything was completely different and much better in Shein’s Guangzhou factories. This aroused our curiosity and provided the impetus for these follow-up interviews. Specifically, the “Supplier Factory Wage Investigation Audit” commissioned in early 2022 stated that the salaries paid by Shein suppliers in southern China were above average. This is what it says in the concise online summary of the report. To enable us to understand how this conclusion was reached, we first asked Shein and then the three audit organizations SGS, TÜV Rheinland and Intertek, which performed the audit together, to allow us a look at the complete report – but to no avail.

The online summary sounds more like a reactive PR message than a professional analysis. This is not only due to the scarcity of detail, but mainly to the lack of two key elements, without which a wage audit simply doesn’t make sense. Firstly, there is no mention of working hours. When we enquired further, Shein confirmed that the wages quoted were the total amounts paid. However, assessing income earned without taking into account the hours worked is about as meaningful as measuring the speed in a race with a stopwatch, but without reference to the length of the course. And yet, what has been criticized was and is precisely the excessively long and – also under Chinese law – illegal working hours endured. To completely ignore this main issue and refer instead to supposedly above-average wage levels is “whataboutism” in its purest form.

The audit’s second shortcoming is the lack of mention or concealment of the lowest wages. Yet they – and not, for example, the average wage – would be the most relevant indicator of potential violations of rights and the threat of poverty. That this data was collected is suggested by the first, but now deleted, version of Shein's online summary. This version mentioned specific wage amounts, but in each case only the highest, not the lowest.

A later wage investigation, which was also only published as summary, highlights, among other points, that overtime pay accounts for an average of 37 percent of the wages paid, which is a huge proportion.

Deleted quotes and CSR reports

This may explain why the three audit firms have withdrawn their shared praise for their client from the website mentioned. It stated: “Shein clearly takes their responsibility in ensuring that the workers employed by their supplierr’s factories receive fair wages for the work completed.”

Since early 2023, only a screenshot is left from this quote . On inquiry, Shein could not explain why it had disappeared from their website. Meanwhile, TÜV Rheinland said that it “has never issued or approved such a statement.” Like SGS and Intertek, this company conducts thousands such audits every year for all kinds of clients and is one of the leading providers in this controversial industry. It is controversial because social audits are not transparent and often don’t adequately detect genuine problems affecting workplaces. That is why they are frequently used as a fig leaf to cover things up, especially by textile companies.

The two previous sustainability reports have also been removed from the Shein website. The first one seemed to be a hasty reaction to the 75-hour scandal, while the second one, published mid-2023, was more detailed, but failed to acknowledge the huge overtime problem – let alone provide details of specific measures to remedy it. According to Shein, a “redesign” of the relevant section of its website caused this deletion.

But back to Guangzhou. Some interviewees observed a significant increase in the number of surveillance cameras installed in and around suppliers. They believed that the images are forwarded to Shein in real time to allow the company to enforce their regulations. One of these is the ban on child labour. It was summer holidays when we were conducting our interviews, and we could also see toddlers and young people in the workshops. Babysitting was often done in the workplace, especially in the small, unregulated companies. Teenagers, who were 14 or 15 years old according to the investigators’ estimates, performed simple tasks, such as packaging, or sat at the sewing machines themselves, instructed by their parents, presumably to learn their trade. Whether they were paid for this remained unclear. Shein stresses its “strict zero tolerance” for the use of child labour and is promising to fund 25 daycare centres in the current year. In 2023 they already set up 10 such places. Shein also denies any access to the surveillance camera footage.

Major fire risk and unpaid alterations

Based on observations made during the investigation, the official smoking ban is not enforced either. The investigators came across workers with lit cigarettes in stairwells and even in the entrances to fabric warehouses. The fact that most of the products and fabric remnants were simply stacked on the floor increases the fire risk. According to the interviewees, only the work equipment and escape routes are checked during the sporadic factory inspections, but not compliance with the smoking ban.

More feared among the needleworkers than these inspections are the seemingly rigid quality controls, which is rather surprising for a low-cost fashion manufacturer like Shein. If the quality is not up to the company’s expectations, it can be costly. A quality check supervisor stated that his company would be “punished” by having an order cancelled for every defective batch. And any stitcher whose work is not up to scratch (and who can be easily identified from their small orders) has to perform alterations unpaid, according to the interviewees. “Whoever makes the mistake is responsible for putting it right. You have to fix the problem in your own working time”, explains a 50-year-old supervisor. One person mentioned that careless quality controllers would even have to pay a fine of between 300 and 1000 yuan, depending on the condition of the faulty batch. This practice is likely to significantly increase the pressure on the workforce, which is already paid only according to the number of items produced.

Shein’s supplier model in Guangzhou seems to be geared towards smaller businesses, which traditionally produce more for the Chinese market. The group advertises for these companies at trade fairs and via a special website, mentioning that export experience is not required.

While expectations of low-cost fashion in terms of quality in the domestic market match the price, Shein apparently wants to impose higher standards for the international market – probably to shake off the bad reputation of its products. But if you expect the work to be performed carefully, you need to give time for this and pay correspondingly higher prices to suppliers. Shein places stringent demands not only on its needleworkers, but also on other service providers. For instance: photographers must be able to capture 70 to 80 styles in an eight-hour shoot four to five times a week; pattern designers must deliver more than 20 exclusive drafts per month; and image retouching editors must recolour 90 photos a day. So, if you've been wondering how Shein can launch so many new products: it’s all down to piecework at every level.

Missing founder and mysterious sales

Shein is also continuing to show a lack of transparency about its structure, profits, and owners. It has a market presence in more than 150 countries, 19 offices with 11,000 employees and partnerships with 4,600 designers and more than 5,000 suppliers: these are the sparse company figures that appear on its website. For a global corporation that is allegedly preparing for an IPO and that , according to Bloomberg, has been worth USD 45 billion this January, these are precious few facts.

This is why we’ve also updated our 2021 analysis of the Group’s complex structure. As already became apparent at the time, Roadget Business in Singapore has now become the global headquarters.

According to commercial register data, this is still held by Beauty of Fashion Investment. But it’s still unclear who owns this company, which is registered in the British Virgin Islands. According to the United States’ lobbying register, Shein founder Xu Yangtian has a 37 percent stake in the group, but it’s also unclear whether this is held in Beauty of Fashion or another offshore company.

And then the surprise: Xu, who is still acting as CEO according to numerous media reports, stepped down from the Roadget Board of Directors already in March 2023. This is borne out by documents from the Singapore Commercial Register. However, Shein has never publicly given any reason for this withdrawal of a key strategic figure. Leonard Lin Zhiming and co-founder Gu Xiaoqing now manage the key subsidiaries in place of the legendary Shein patron. And there are new subsidiaries popping up all the time. One is Fashion Choice, which was founded in October 2021 and also runs sales in Switzerland.

The turnover figures of the nested group of companies are similarly vague. Annual reports from subsidiaries available to us show that in 2022, Shein generated combined sales of USD 13.8 billion in the three main markets of the EU, US, and UK. This figure is significantly lower than the total revenue estimate provided by the Financial Times for that year (USD 22.7 billion), based on a confidential investor presentation. Does Shein really generate such a large turnover in the rest of the global market? Or do the high figures that have been circulating have something to do with the planned IPO? According to reports from late February, this might not take place on Wall Street, but in London, contrary to what was originally planned.

More infos

-

Overdue annual report

We would have liked to analyse the parent company’s latest annual report, because global sales should also feature in it. Roadget ought to have held its annual general meeting last summer and filed its 2022 financial results with the register. In June 2023, the company applied for a two-month extension. The reason given was: “the auditors need more time.” But six months on, still no documents have been filed with the register.

-

Risk-happy investors

Undeterred by this state of affairs, investors are pumping billions into Shein’s expansion strategy, according to a Chinese company database. According to this source, venture capitalists Sequoia Capital, Tiger Global Management, General Atlantic, DST Global and Coatue Management, as well as Abu Dhabi’s sovereign wealth fund Mubadala, have invested around USD 3.5 billion in the group since 2022. Citibank, Barclays, and BNP Paribas have also recently granted Roadget loans for an undisclosed amount. This should make them among the few who are familiar with Shein’s actual figures and structure.

-

Millions in profits and tax giveaways

According to Roadget’s 2021 annual report, Shein’s business has been booming this year. Despite a narrow trading margin of 15 percent compared to the industry, the Group reported a pre-tax profit of USD 220 million. And because Singapore provided the headquarters of the Chinese online fashion giant with a sweetening 5-year tax remission, the effective tax rate was only 10.6 percent.

Politicians are alarmed, but have not taken any action (yet)

The lack of change in terms of excessive overtime and the other findings from our investigations indicate: Shein will only assume more social responsibility when subjected to external pressure. Would an IPO force the throwaway fashion company to become more sustainable? Hardly. The recent billion-dollar investments show that there are still enough backers who see Shein’s business model providing a profit opportunity and who don’t consider greenwashing as an investment risk.

However, parliaments and governments have available the most effective lever for remedying the grievances highlighted above. At the time of our pioneering investigation in 2021, Shein was still a fairly new and very bright star in this sector. Three years down the line, politicians can no longer ignore the problems caused by this group – also because Temu has now followed in Shein's online footsteps, offering an even wider range of low-cost goods. In actual fact, various initiatives introduced in France, the EU, the United States and also Switzerland reflect the alarm felt by legislators. But do they also have the courage to finally put fast-fashion companies in their place? And not just by passing a weak “Lex Shein” to keep the low-cost competitor from China at bay to protect the fashion industry, which is under pressure, but by taking effective action. Because what we need is a fashion industry where no one has to sew clothes 12 hours a day anymore – clothes that are first flown around the world and then end up in the bin, having hardly been worn.

* To ensure transparency and good legibility, we are providing Shein’s entire reply email in a separate document.

Image 1: The cover image was taken from the 2021 Public Eye research on Shein ©panos

Image 2: The image of workers in Guangzhou was secretly taken during our visit in 2023.

Image 3: The image of the night sky over Guangzhou was taken from the 2021 Public Eye research on Shein ©panos